Thu, Feb 17, 2022

Risk to Shareholders Too High To Fight FTC In Court, Says CEO

Lockheed Martin has rescinded its $4.4 billion bid to acquire Aerojet Rocketdyne, saying that fighting the Federal Trade Commission lawsuit in court would create too much risk for shareholders, despite the positive aspects that the integration would create.

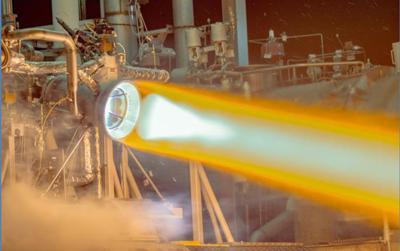

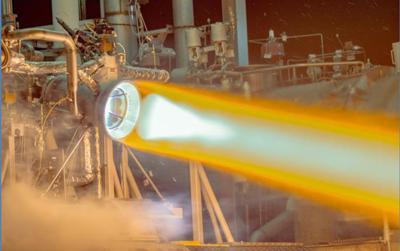

The deal has been in the works since 2020, when Lockheed targeted Aerojet in order to establish a foundation for its hypersonic, missile defense, and space travel programs. Aerojet was a fairly good target for acquisition, with plenty of business in its order book but hungry for a backer with deeper pockets. The FTC took issue with the prospective deal because the two companies essentially make up the entirety of the domestic rocket motor production base. Until 2018, Orbital ATK was a third company among the competition, but they were swallowed up by Northrop Grumman for similar reasons as the Lockheed merger.

The FTC reacted quite seriously to the deal, with a vote to block the deal standing at 4-0. Their concerns lay with the resulting near monopoly over rocket development and manufacture. Bureau of Competition director Holly Vedova said the deal would ultimately close off “our nation’s last independent supplier of key missile inputs,” adding:

“Lockheed is one of a few missile middlemen the U.S. military relies on to supply vital weapons that keep our country safe. If consummated, this deal would give Lockheed the ability to cut off other defense contractors from the critical components they need to build competing missiles. Without competitive pressure, Lockheed can jack up the price the US Government has to pay, while delivering lower quality and less innovation. We cannot afford to allow further concentration in markets critical to our national security and defense.”

The cancellation of the deal is somewhat surprising, given the can-do attitude held in previous Lockheed statements. They had given an impression of confidence in their chances of prevailing in court, but sliding earnings and wavering investor confidence likely made a protracted legal battle less exciting than previously thought. To some, the change was expected after nearly no one in the defense industry raised their voice in defense of the deal. With the Department of Defense mum on the issue, it may have given the impressions they agreed with the FTC. Both companies made statements on a Sunday, with Lockheed saying “terminating the transaction is in the best interest of our stakeholders,” and Aerojet reiterating its “impressive backlog that is more than three times the size of our annual sales.”

More News

He Attempted To Restart The Engine Three Times. On The Third Restart Attempt, He Noticed That Flames Were Coming Out From The Right Wing Near The Fuel Cap Analysis: The pilot repor>[...]

Make Sure You NEVER Miss A New Story From Aero-News Network Do you ever feel like you never see posts from a certain person or page on Facebook or Instagram? Here’s how you c>[...]

From 2009 (YouTube Edition): Leading Air Show Performers Give Their Best Advice for Newcomers On December 6th through December 9th, the Paris Las Vegas Hotel hosted over 1,500 air >[...]

Aero Linx: NASA ASRS ASRS captures confidential reports, analyzes the resulting aviation safety data, and disseminates vital information to the aviation community. The ASRS is an i>[...]

“For our inaugural Pylon Racing Seminar in Roswell, we were thrilled to certify 60 pilots across our six closed-course pylon race classes. Not only did this year’s PRS >[...]

NTSB Final Report: Rutan Long-EZ

NTSB Final Report: Rutan Long-EZ ANN FAQ: Turn On Post Notifications

ANN FAQ: Turn On Post Notifications Classic Aero-TV: ICAS Perspectives - Advice for New Air Show Performers

Classic Aero-TV: ICAS Perspectives - Advice for New Air Show Performers ANN's Daily Aero-Linx (06.28.25)

ANN's Daily Aero-Linx (06.28.25) Aero-News: Quote of the Day (06.28.25)

Aero-News: Quote of the Day (06.28.25)