Sat, Apr 27, 2024

Q1 2024 Sees Spike in Preowned Aircraft

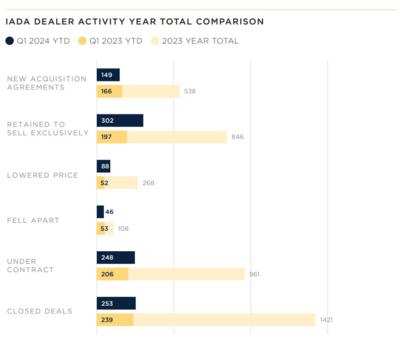

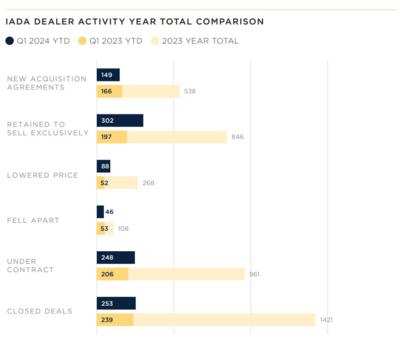

The first quarter of 2024 has seen a notable uptick in the sales of preowned business aircraft, sparking continued optimism in the market, as reported by the International Aircraft Dealers Association (IADA). The association's latest market report highlights a robust start to the year, with 253 resale transactions recorded in the first quarter, showing an increase from 239 during the same period in 2023. Additionally, there were 248 aircraft under contract by the end of the first quarter, up from 206 at the close of the first quarter the previous year.

The growth in transactions is seen across several aircraft categories, with particularly strong interest in large and ultra-long-range jets. This category is expected to see some price adjustments and a rise in inventory levels over the next six months, according to insights from IADA members. The overall sentiment reflects a cautious yet positive outlook for the near future, despite potential market uncertainties due to regional unrest and the upcoming U.S. presidential election.

Phil Winters, Vice President of Aircraft Sales and Charter Management for Western Aircraft and IADA Chairman, expressed satisfaction with the market's performance. "I'm happy to report that the first quarter proved to be more active than we had expected," he said. The projections for the next six months suggest a continuation of this trend, with a healthy balance of supply and demand in the market.

Wayne Starling, IADA Executive Director, pointed out that the responses from the quarterly member survey indicate a significant anticipation of change in the high-end segment of the market. "About three-quarters of the IADA respondents believe that Large and Ultra-Long-Range Jet resale pricing will fall, and that inventories will rise over the next six months," Starling noted, emphasizing that the most pronounced changes are expected at the top of the market.

This quarter's results also reflect a market rebalancing after the surge in activity following the COVID-19 pandemic, which had previously drained available inventory and driven up transaction prices. With fresh inventory continuing to enter the market and demand stabilizing, the preowned aircraft market is positioned to maintain robust activity levels, supported by both historical data and current trends. The IADA continues to play a critical role in providing data-driven insights and fostering transparency in the preowned aircraft market, ensuring stakeholders are well-informed and prepared for future developments.

More News

“These new aircraft strengthen our ability to respond quickly, train effectively and support communities nationwide. Textron Aviation has been a steadfast supporter in helpin>[...]

From 2011 (YouTube Edition): Rugged, Legendary, STOL Twin Makes A Comeback The de Havilland Twin Otter is an airplane with a long history, and it gained a reputation as a workhorse>[...]

A Wind Gust Lifted The Right Wing And The Airplane Turned To The Left Analysis: The pilot was departing from a 2,395-ft-long by 50-ft-wide turf runway. The pilot reported that afte>[...]

Have A Story That NEEDS To Be Featured On Aero-News? Here’s How To Submit A Story To Our Team Some of the greatest new stories ANN has ever covered have been submitted by our>[...]

Braking Action Advisories When tower controllers receive runway braking action reports which include the terms “medium," “poor," or “nil," or whenever weather con>[...]

Aero-News: Quote of the Day (12.18.25)

Aero-News: Quote of the Day (12.18.25) Classic Aero-TV: Viking Twin Otter 400--Bringing the DHC-6 Back Into Production

Classic Aero-TV: Viking Twin Otter 400--Bringing the DHC-6 Back Into Production NTSB Final Report: Rans Employee Flying Club Rans S-6ES Coyote II

NTSB Final Report: Rans Employee Flying Club Rans S-6ES Coyote II ANN FAQ: Submit a News Story!

ANN FAQ: Submit a News Story! ANN's Daily Aero-Term (12.18.25): Braking Action Advisories

ANN's Daily Aero-Term (12.18.25): Braking Action Advisories