Business Jet Orders Up

Bombardier Inc. said this week that

it will increase production due to stronger deliveries of aircraft

and posting a 23 percent rise in quarterly profits. Bombardier,

named Pierre Beaudoin as president and chief executive effective

June 4 to the world's third-largest civil aircraft maker and the

number one manufacturer of trains.

Bombardier Inc. said this week that

it will increase production due to stronger deliveries of aircraft

and posting a 23 percent rise in quarterly profits. Bombardier,

named Pierre Beaudoin as president and chief executive effective

June 4 to the world's third-largest civil aircraft maker and the

number one manufacturer of trains.

Beaudoin, 45, is the head of the company's aerospace unit and

the son of current president and CEO Laurent Beaudoin, 69. The

senior Beaudoin has been with the company for 45 years and will

stay on as chairman of the board. The company said it earned $91

million, or 5 cents a share, in the third quarter ending October.

31. That was up from a year-earlier profit of $74 million, or 4

cents a share, according to Reuters.

Revenue rose 15 percent to $4.2 billion from $3.4 billion,

because of higher deliveries of regional and business aircraft.

Analysts anticipated that Bombardier would post a profit of 5 cents

a share, before items, in the latest quarter, on revenue of $3.93

billion.

"We believe these good results still mostly reflect the

favorable business jet environment," Claude Proulx, analyst at BMO

Capital Markets, wrote in a research report. This raised

Bombardier's share price by 9 percent last week. By early Wednesday

afternoon, its class B shares were up 50 Canadian cents at C$5.98

on the Canadian Toronto Stock Exchange. An analyst at UBS

Investment Research, Fadi Chamoun, said Bombardier's aerospace

revenues, were $2.35 billion, higher than his $2.1 billion forecast

due to increased aircraft deliveries.

Chamoun noted that Bombardier is maintaining its target for

pretax profit margins of 8 percent in aerospace and 6 percent in

train-making despite costs stemming from the higher Canadian and

European currencies. Charges in the third quarter included $23

million related to a change in the company's long-term foreign

exchange assumption for the Canadian dollar. Subsequently,

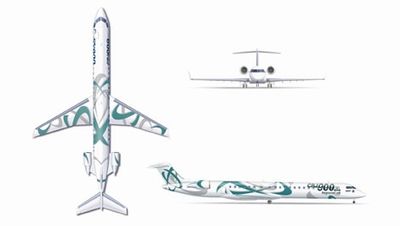

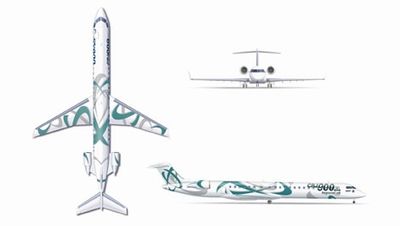

Bombardier said it would increase the production rate for its

CRJ700 and CRJ900 jets to one aircraft every three days from one

every four days. This followed a new plan offered in August.

"Right now, there is very strong demand for CRJs, both in the

U.S. and internationally, and that is why we are increasing rates

again on the CRJ700 and 900," Pierre Beaudoin. The orders will not

change their current workforce size.

The company expects to make about 50 CRJ700s and CRJ900s this

financial year, which ends Jan. 31. Next year it plans to make 64.

Lifted by aircraft deliveries, Bombardier said it had $3.6 billion

of cash and equivalents at Oct. 31 and plans to buy back some $1.1

billion of debt by Jan. 31. The buyback is part of the company's

goal of returning its debt to investment grade, executives said.

Bombardier's main rival in the regional jet market is Brazil's

Embraer whose order backlog at the end of the quarter was a record

$19.6 billion in aerospace and $32 billion in trains.

The third quarter profit was due to selling prices for wide-body

business jest and RJs, but was hindered by the strengthening of the

Canadian currency and British pound sterling against the U.S.

dollar, according to Bombardier. Profit before interest and taxes

jumped to $122 million in the group's aerospace division, and from

$43 million a year earlier as aircraft deliveries climbed to 90

from 73.

Jet orders increased 124 from 95 a year earlier, with net orders

for business aircraft jumping to 112 from 57.

ANN's Daily Aero-Term (05.19.25): Fuel Remaining

ANN's Daily Aero-Term (05.19.25): Fuel Remaining ANN's Daily Aero-Linx (05.19.25)

ANN's Daily Aero-Linx (05.19.25) Klyde Morris (05.16.25)

Klyde Morris (05.16.25) Airborne 05.19.25: Kolb v Tornados, Philippine Mars, Blackhawk Antler Theft

Airborne 05.19.25: Kolb v Tornados, Philippine Mars, Blackhawk Antler Theft Airborne-Flight Training 05.15.25: Ray Scholarship, Alto NG, Fighter Training

Airborne-Flight Training 05.15.25: Ray Scholarship, Alto NG, Fighter Training