Mon, Feb 26, 2018

Urge Transportation Secretary Elaine Chao To Oppose A Doubling Of The Airport Tax Passengers Pay With The Purchase Of Each Flight

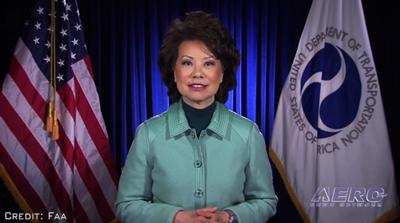

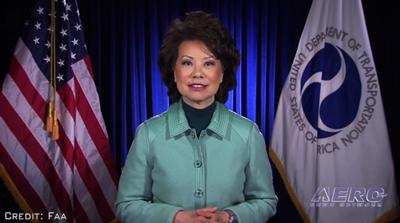

Airlines for America (A4A), an industry trade organization and lobbying group for the leading U.S. airlines, has released a letter from the CEOs of six leading U.S. commercial airlines, urging Transportation Secretary Elaine Chao to oppose any attempt to increase the current Passenger Facility Charge (PFC), also known as the airport tax.

In their letter to Secretary Chao (pictured), the CEOs of Alaska Airlines, American Airlines, Hawaiian Airlines, JetBlue Airways, Southwest Airlines and United Airlines noted that the Senate Transportation, Housing and Urban Development (THUD) appropriations bill contains a massive tax hike on travelers, simply for using the airport. Nearly doubling the PFC, which is neither justified nor needed, was proposed despite the fact that U.S. airports are in a strong financial position, sitting on billions of dollars in revenue collected from government and airline passengers.

Specifically, in 2016, airports:

- had more than $14.2 billion in unrestricted cash and investments on hand;

- collected record revenues from airline rents and fees and existing PFCs;

- had access to nearly $6 billion in uncommitted funding for airport infrastructure projects in the Airport and Airway Trust Fund (AATF). In addition to these cash streams, over the last decade airlines have partnered with airports on more than $100 billion in improvement projects at the country’s largest 30 airports alone, as well as smaller airports nationwide; and

- diverted over $9 billion off airport to non-aviation related projects.

“We have nearly $6 billion in unobligated funding in the Airport and Airway Trust Fund that could be utilized for airport infrastructure,” states the letter from the CEOs of major passenger carriers, who are also A4A Board of Directors members. “Airlines are committed to making capital improvements in infrastructure alongside our well-funded airport partners, and we respectfully ask for your commitment to solutions that do not involve unnecessary tax increases on the traveling public.”

Contrary to the Administration’s historic tax reform package that provided tax relief to all Americans, the average traveler still pays 21 percent of the total cost of a roundtrip airline ticket to the federal government – the same tax bracket designed to discourage use of so-called “sin products.”

(Source: A4A news release)

More News

From 2016 (YouTube Edition): The Canadian Forces Snowbirds Can Best Be Described As ‘Elegant’… EAA AirVenture 2016 was a great show and, in no small part, it was>[...]

Airplane Lunged Forward When It Was Stuck From Behind By A Tug That Was Towing An Unoccupied Airliner Analysis: At the conclusion of the air taxi flight, the flight crew were taxii>[...]

Aero Linx: International Stinson Club So you want to buy a Stinson. Well the Stinson is a GREAT value aircraft. The goal of the International Stinson Club is to preserve informatio>[...]

Request Full Route Clearance Used by pilots to request that the entire route of flight be read verbatim in an ATC clearance. Such request should be made to preclude receiving an AT>[...]

"Today's battlefield is adapting rapidly. By teaching our soldiers to understand how drones work and are built, we are giving them the skills to think creatively and apply emerging>[...]

Classic Aero-TV: Pure Aerial Precision - The Snowbirds at AirVenture 2016

Classic Aero-TV: Pure Aerial Precision - The Snowbirds at AirVenture 2016 NTSB Final Report: Costruzioni Aeronautiche Tecna P2012 Traveller

NTSB Final Report: Costruzioni Aeronautiche Tecna P2012 Traveller ANN's Daily Aero-Linx (11.23.25)

ANN's Daily Aero-Linx (11.23.25) ANN's Daily Aero-Term (11.23.25): Request Full Route Clearance

ANN's Daily Aero-Term (11.23.25): Request Full Route Clearance Aero-News: Quote of the Day (11.23.25)

Aero-News: Quote of the Day (11.23.25)