Thu, Feb 17, 2022

Risk to Shareholders Too High To Fight FTC In Court, Says CEO

Lockheed Martin has rescinded its $4.4 billion bid to acquire Aerojet Rocketdyne, saying that fighting the Federal Trade Commission lawsuit in court would create too much risk for shareholders, despite the positive aspects that the integration would create.

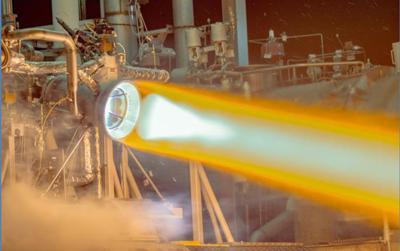

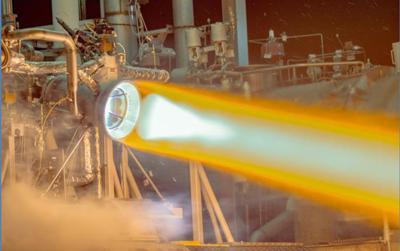

The deal has been in the works since 2020, when Lockheed targeted Aerojet in order to establish a foundation for its hypersonic, missile defense, and space travel programs. Aerojet was a fairly good target for acquisition, with plenty of business in its order book but hungry for a backer with deeper pockets. The FTC took issue with the prospective deal because the two companies essentially make up the entirety of the domestic rocket motor production base. Until 2018, Orbital ATK was a third company among the competition, but they were swallowed up by Northrop Grumman for similar reasons as the Lockheed merger.

The FTC reacted quite seriously to the deal, with a vote to block the deal standing at 4-0. Their concerns lay with the resulting near monopoly over rocket development and manufacture. Bureau of Competition director Holly Vedova said the deal would ultimately close off “our nation’s last independent supplier of key missile inputs,” adding:

“Lockheed is one of a few missile middlemen the U.S. military relies on to supply vital weapons that keep our country safe. If consummated, this deal would give Lockheed the ability to cut off other defense contractors from the critical components they need to build competing missiles. Without competitive pressure, Lockheed can jack up the price the US Government has to pay, while delivering lower quality and less innovation. We cannot afford to allow further concentration in markets critical to our national security and defense.”

The cancellation of the deal is somewhat surprising, given the can-do attitude held in previous Lockheed statements. They had given an impression of confidence in their chances of prevailing in court, but sliding earnings and wavering investor confidence likely made a protracted legal battle less exciting than previously thought. To some, the change was expected after nearly no one in the defense industry raised their voice in defense of the deal. With the Department of Defense mum on the issue, it may have given the impressions they agreed with the FTC. Both companies made statements on a Sunday, with Lockheed saying “terminating the transaction is in the best interest of our stakeholders,” and Aerojet reiterating its “impressive backlog that is more than three times the size of our annual sales.”

More News

19-Year-Old Pilot Was Attempting to Fly Solo to All Seven Continents On his journey to become the first pilot to land solo on all seven continents, 19-year-old Ethan Guo has hit a >[...]

From 2017 (YouTube Edition): A Quality LSA For Well Under $100k… Aeroprakt unveiled its new LSA at the Deland Sport Aviation Showcase in November. Dennis Long, U.S. Importer>[...]

Hazardous Weather Information Summary of significant meteorological information (SIGMET/WS), convective significant meteorological information (convective SIGMET/WST), urgent pilot>[...]

Aero Linx: Historic Aircraft Association (HAA) The Historic Aircraft Association (HAA) was founded in 1979 with the aim of furthering the safe flying of historic aircraft in the UK>[...]

"We would like to remember Liam not just for the way he left this world, but for how he lived in it... Liam was fearless, not necessarily because he wasn't afraid but because he re>[...]

TikToker Arrested After Landing His C182 in Antarctica

TikToker Arrested After Landing His C182 in Antarctica Classic Aero-TV: Versatile AND Practical - The All-Seeing Aeroprakt A-22 LSA

Classic Aero-TV: Versatile AND Practical - The All-Seeing Aeroprakt A-22 LSA ANN's Daily Aero-Term (06.27.25): Hazardous Weather Information

ANN's Daily Aero-Term (06.27.25): Hazardous Weather Information ANN's Daily Aero-Linx (06.27.25)

ANN's Daily Aero-Linx (06.27.25) Aero-News: Quote of the Day (06.27.25)

Aero-News: Quote of the Day (06.27.25)