Tue, Mar 04, 2014

Tax Overhaul Draft Plan Proposed By Ways And Means Committee Chairman Dave Camp

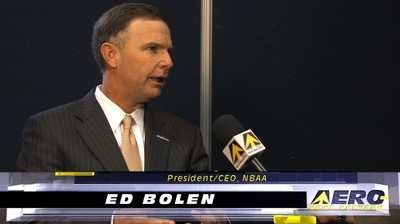

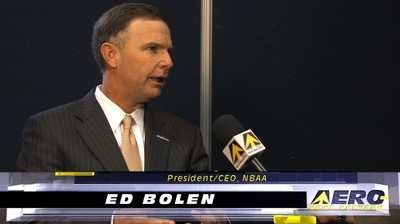

National Business Aviation Association (NBAA) President and CEO Ed Bolen says a congressman’s draft tax-overhaul plan unfairly mischaracterizes and singles out tax depreciation on the purchase of general aviation (GA) aircraft used by businesses, farms, healthcare providers, flight schools, emergency responders and others to connect communities and grow businesses across the U.S.

“A tax proposal outlined in a Feb. 26 commentary by House Ways and Means Committee Chairman Dave Camp (R-TX) (pictured), suggesting that the depreciation schedule for general aviation (GA) aircraft purchases is a ‘special benefit,’ is simply not accurate,” Bolen said in a Letter to the Editor of The Wall Street Journal.

In his letter, Bolen added: “Mischaracterizations like those from Chairman Camp may make for an eye-catching gimmick for Journal readers, but they do little to advance comprehensive tax reform that incentivizes the business capital investments that drive economic growth and the creation of jobs.”

He added: “As economists, members of Congress and the many Americans who rely on the industry for their livelihoods can attest, general aviation is a crucially important driver in our economy, and the depreciation schedule for the purchase of a business aircraft has – just like a host of other business assets – been on the books for decades. Such depreciation schedules apply to everything from computers to cars to aircraft, and the idea behind such policies is to encourage American businesses to continually upgrade the products they use, so they can remain competitive in today’s tough global marketplace.

“Even the Joint Committee on Taxation (JCT), which Chairman Camp references, has concluded that repealing provisions such as the Modified Accelerated Cost Recovery System – which sets cost-recovery rules for business aircraft and a wide variety of other types of property – would have a long-term negative impact on the economy and capital investment,” Bolen’s letter went on to note.

“Comments like these from a House leader can harm the people and companies involved in the manufacture and use of an airplane for business — an industry that accounts for 1.2 million jobs and $150 billion in economic activity," Bolen said. "Words have consequences, and this is an important industry. That’s why economists, representatives with organized labor, small business champions and others have supported retaining or shortening aircraft-depreciation schedules, in order to promote their purchase, and preserve the jobs that come with it."

Bolen said the business aviation industry welcomes the opportunity to be a part of the tax-reform conversation, and will continue to educate lawmakers on the important role that cost-recovery policies play in the business-investment decisions that impact essential industries like general aviation.

“We agree with Chairman Camp that any discussion of tax reform should focus on strengthening the U.S. economy and ensuring that the code is equitable and supports growth,” he said.

More News

Aero Linx: International Federation of Airworthiness (IFA) We aim to be the most internationally respected independent authority on the subject of Airworthiness. IFA uniquely combi>[...]

Ultrahigh Frequency (UHF) The frequency band between 300 and 3,000 MHz. The bank of radio frequencies used for military air/ground voice communications. In some instances this may >[...]

A Few Questions AND Answers To Help You Get MORE Out of ANN! 1) I forgot my password. How do I find it? 1) Easy... click here and give us your e-mail address--we'll send it to you >[...]

From 2019 (YouTube Edition): Learning To Paint Without Getting Any On Your Hands PPG's Aerospace Coatings Academy is a tool designed to teach everything one needs to know about all>[...]

Also: Sustainable Aircraft Test Put Aside, More Falcon 9 Ops, Wyoming ANG Rescue, Oreo Cookie Into Orbit Joby Aviation has reason to celebrate, recently completing its first full t>[...]

ANN's Daily Aero-Linx (05.06.25)

ANN's Daily Aero-Linx (05.06.25) ANN's Daily Aero-Term (05.06.25): Ultrahigh Frequency (UHF)

ANN's Daily Aero-Term (05.06.25): Ultrahigh Frequency (UHF) ANN FAQ: Q&A 101

ANN FAQ: Q&A 101 Classic Aero-TV: Virtual Reality Painting--PPG Leverages Technology for Training

Classic Aero-TV: Virtual Reality Painting--PPG Leverages Technology for Training Airborne 05.02.25: Joby Crewed Milestone, Diamond Club, Canadian Pilot Insurance

Airborne 05.02.25: Joby Crewed Milestone, Diamond Club, Canadian Pilot Insurance