Thu, Feb 17, 2022

Risk to Shareholders Too High To Fight FTC In Court, Says CEO

Lockheed Martin has rescinded its $4.4 billion bid to acquire Aerojet Rocketdyne, saying that fighting the Federal Trade Commission lawsuit in court would create too much risk for shareholders, despite the positive aspects that the integration would create.

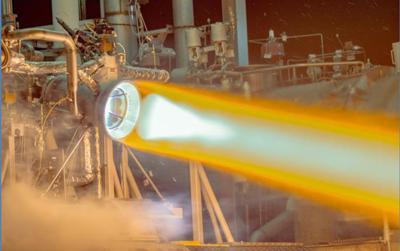

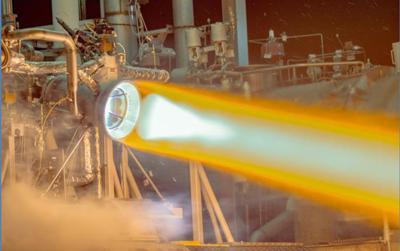

The deal has been in the works since 2020, when Lockheed targeted Aerojet in order to establish a foundation for its hypersonic, missile defense, and space travel programs. Aerojet was a fairly good target for acquisition, with plenty of business in its order book but hungry for a backer with deeper pockets. The FTC took issue with the prospective deal because the two companies essentially make up the entirety of the domestic rocket motor production base. Until 2018, Orbital ATK was a third company among the competition, but they were swallowed up by Northrop Grumman for similar reasons as the Lockheed merger.

The FTC reacted quite seriously to the deal, with a vote to block the deal standing at 4-0. Their concerns lay with the resulting near monopoly over rocket development and manufacture. Bureau of Competition director Holly Vedova said the deal would ultimately close off “our nation’s last independent supplier of key missile inputs,” adding:

“Lockheed is one of a few missile middlemen the U.S. military relies on to supply vital weapons that keep our country safe. If consummated, this deal would give Lockheed the ability to cut off other defense contractors from the critical components they need to build competing missiles. Without competitive pressure, Lockheed can jack up the price the US Government has to pay, while delivering lower quality and less innovation. We cannot afford to allow further concentration in markets critical to our national security and defense.”

The cancellation of the deal is somewhat surprising, given the can-do attitude held in previous Lockheed statements. They had given an impression of confidence in their chances of prevailing in court, but sliding earnings and wavering investor confidence likely made a protracted legal battle less exciting than previously thought. To some, the change was expected after nearly no one in the defense industry raised their voice in defense of the deal. With the Department of Defense mum on the issue, it may have given the impressions they agreed with the FTC. Both companies made statements on a Sunday, with Lockheed saying “terminating the transaction is in the best interest of our stakeholders,” and Aerojet reiterating its “impressive backlog that is more than three times the size of our annual sales.”

More News

Also: ANOTHER Illegal Drone, KidVenture Educational Activities, Record Launches, TSA v Shoes The Senate confirmed Bryan Bedford to become the next Administrator of the FAA, in a ne>[...]

Also: Sully v Bedford, Embraer Scholarships, NORAD Intercepts 11, GAMA Thankful Middle Georgia State University will be joining the Federal Aviation Administration’s fight ag>[...]

Also: DarkAero Update, Electric Aircraft Symposium, Updated Instructor Guide, OSH Homebuilts Celebrate The long-awaited Sonex High Wing prototype has flown... the Sonex gang tells >[...]

Also: Sully v Bedford, Embraer Scholarships, NORAD Intercepts 11, GAMA Thankful Middle Georgia State University will be joining the Federal Aviation Administration’s fight ag>[...]

30-Year USCG Veteran Aviator Focusing On Member Benefits The Vertical Aviation International Board of Directors announced its new leadership officers in April, and all began their >[...]

Airborne 07.11.25: New FAA Boss, New NASA Boss (Kinda), WB57s Over TX

Airborne 07.11.25: New FAA Boss, New NASA Boss (Kinda), WB57s Over TX Airborne-Flight Training 07.10.25: ATC School, Air Race Classic, Samson School

Airborne-Flight Training 07.10.25: ATC School, Air Race Classic, Samson School Airborne Affordable Flyers 07.03.25: Sonex HW, BlackShape Gabriel, PRA Fly-In 25

Airborne Affordable Flyers 07.03.25: Sonex HW, BlackShape Gabriel, PRA Fly-In 25 Airborne-Flight Training 07.10.25: ATC School, Air Race Classic, Samson School

Airborne-Flight Training 07.10.25: ATC School, Air Race Classic, Samson School Rick Kenin New Board Chair of VAI

Rick Kenin New Board Chair of VAI