Chapter 11 Has Unreported Consequences

Chapter 11 of the US Bankruptcy Code affords "protection" to

the company whose application is accepted. Chapter 11 was designed

by politicians, to give companies that couldn't meet expenses, an

extended chance. Once under court protection, Chapter 11 companies

don't have the day-to-day freedom to make decisions the way they

did before they entered; but their creditors can't collect, either,

unless and until the judge says so.

Chapter 11 of the US Bankruptcy Code affords "protection" to

the company whose application is accepted. Chapter 11 was designed

by politicians, to give companies that couldn't meet expenses, an

extended chance. Once under court protection, Chapter 11 companies

don't have the day-to-day freedom to make decisions the way they

did before they entered; but their creditors can't collect, either,

unless and until the judge says so.

Employees get paid; creditors do not. That simple fact

identifies the political reality: Chapter 11 is a "jobs" program,

designed to curry favor with employees of companies that can't make

it in the harsh marketplace. The way it's usually presented,

Chapter 11 looks like a "second chance" for a struggling company.

It prevents "jobs from being lost." It "keeps creditors at bay,"

while the bankrupt company sees if it can "return a good portion of

the dollar to creditors, instead of just pennies."

Assuming those are all noble (if economically ignorant, and

economically unjust) ideals, what else happens, when a company

doesn't have to face the music? That part about keeping the company

afloat while it restructures itself sure sounds good; but Chapter

11 still (although not as much as in past decades) impacts company

image among consumers.

With revenues down, how is a Chapter 11 company supposed to make

it? The "protection" explains things: without having to pay

existing debts, including most interest, the company in Chapter 11,

even with significant loss of revenue, often has more operating

room than its non-bankrupt competition. "That's good," you say.

"The struggling company needs a competitive advantage."

Here's where the unintended consequences come into play.

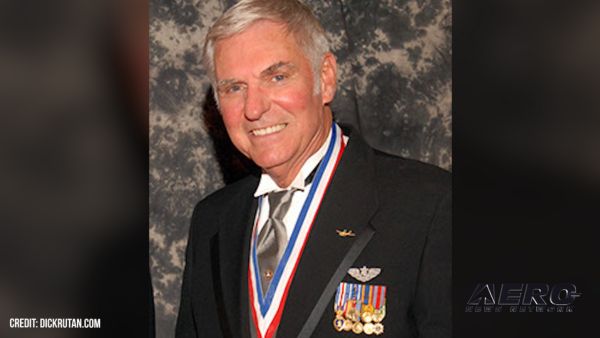

In an official press release yesterday, American

Airlines, under CEO Don Carty (right), noted that that, while

it's not yet publicly contemplating filing for Chapter 11, it faces

unfair competition from airlines that already are operating under

court protection. One particularly-telling sentence said the

unthinkable: "The company cited pricing actions by low-cost

and bankrupt carriers among the factors putting

'unrelenting pressure' on the company's financial situation." In

other words, as United and US Airways don't have to pay their

(prepetition) suppliers' debts and interest, American, operating in

the clear, does. United and US Airways thus have more room to cut

fares, making it possible to lure PAX away from American.

In an official press release yesterday, American

Airlines, under CEO Don Carty (right), noted that that, while

it's not yet publicly contemplating filing for Chapter 11, it faces

unfair competition from airlines that already are operating under

court protection. One particularly-telling sentence said the

unthinkable: "The company cited pricing actions by low-cost

and bankrupt carriers among the factors putting

'unrelenting pressure' on the company's financial situation." In

other words, as United and US Airways don't have to pay their

(prepetition) suppliers' debts and interest, American, operating in

the clear, does. United and US Airways thus have more room to cut

fares, making it possible to lure PAX away from American.

If United and US Airways were playing on a level field, American

thus points out, those airlines would be forced to pay their debts,

or go out of business. Since they are, momemtarily, "untouchable,"

American can't compete on price, all other things' equal. Thus, the

responsible competitor, American Airlines, may well be forced into

bankruptcy by the competitors that are being kept on court-ordered

life support.

What if everybody did it?

Of course,

US Airways and United's suppliers' not getting paid their just

deserts will continue to have dire consequenses downstream.

Creditors, from Boeing, to airports and cities, to caterers, still

have to pay their bills -- except they now have to do it, without

the money the Chapter 11 airlines owed them. This puts additional

businesses at risk -- businesses that are most certainly

not competing with United, or with US Airways. If more and

more companies start feeling that their customer-companies are

headed for Chapter 11, the credit and cooperation among companies

will diminish, actually provoking more filings, as more companies

take advantage of the courts.

Of course,

US Airways and United's suppliers' not getting paid their just

deserts will continue to have dire consequenses downstream.

Creditors, from Boeing, to airports and cities, to caterers, still

have to pay their bills -- except they now have to do it, without

the money the Chapter 11 airlines owed them. This puts additional

businesses at risk -- businesses that are most certainly

not competing with United, or with US Airways. If more and

more companies start feeling that their customer-companies are

headed for Chapter 11, the credit and cooperation among companies

will diminish, actually provoking more filings, as more companies

take advantage of the courts.

It should be easy to see that, in the long run, Chapter 11

"protection" is not a good idea -- even for those workers whose

jobs are temporarily "saved." Politicians, though, will continue to

pander. Economists, with lower profiles, will continue to pull

their hair out...

ANN's Daily Aero-Term (05.05.24): Omnidirectional Approach Lighting System

ANN's Daily Aero-Term (05.05.24): Omnidirectional Approach Lighting System Aero-News: Quote of the Day (05.05.24)

Aero-News: Quote of the Day (05.05.24) Airborne 05.06.24: Gone West-Dick Rutan, ICON BK Update, SpaceX EVA Suit

Airborne 05.06.24: Gone West-Dick Rutan, ICON BK Update, SpaceX EVA Suit Airborne 05.03.24: Advanced Powerplant Solutions, PRA Runway Woes, Drone Racing

Airborne 05.03.24: Advanced Powerplant Solutions, PRA Runway Woes, Drone Racing Aero-News: Quote of the Day (05.06xx.24)

Aero-News: Quote of the Day (05.06xx.24)