Report Covers Pre-Owned Business Jet, Business Turboprop, Helicopter, And Commercial Airliner Sales

JETNET’s recently-released aviation market analysis for 2013 shows percentage of aircraft for sale dropping in almost every market sector. In what is still a buyer’s market, pre-owned business jet sales transactions are up, and the economy is finally growing at a pace that is prime for positive business aviation growth. The December 2013 and 2013 year-ending results for the pre-owned business jet, business turboprop, helicopter and commercial airliner markets.

JETNET is reporting key worldwide trends across all market sectors, with over 8,300 full retail sale transactions for 2013. Except for turbine helicopters, which showed a slight increase, the fleet “For Sale” percentages for all market sectors were down in the December comparisons, with the largest drop in business jets, to 12.5% from 13.4% in December 2012.

The company says the "For Sale" inventories continue to decline:

- Business jets for sale were at 12.5% (down 0.9 from 13.4%)

- Business turboprops for sale were at 7.7% (down .6 from 8.3%)

- Turbine helicopters for sale were at 6.4% (up 0.3 from 6.1%)

- Piston helicopters for sale were at 6.0% (down 0.1 from 6.1%)

Full Sale Transactions had mixed results, with only business jets showing growth:

- Business jets were up (0.6%)

- Business turboprops were down (-8.8%)

- Both turbine (-11.8%) and piston (-13.5%) helicopters were down by double-digits

Average Days on Market are all at very high levels, but all market sectors showed decreases in Average Days on Market at year-end, except business jets which took 20 more days. The average asking prices had mixed results, with Business jets up 10.7% and business turboprops up 5.9%, but Turbine helicopters down 2.5% and piston helicopters off 1.3% decreased

Several significant events have occurred since 2005 in the Business Jet “For Sale” inventory. First, in the past 9 years the market has remained in a “Buyer’s Market”, based on 10% or greater fleet percentage of the in-operation business jets For Sale. Second, after several years of record sales and rising aircraft values, the bubble finally burst in 2008 amid a world economic collapse and banking crisis of historic proportion. From 2007, there was a large increase in business jets in the “For Sale” inventory: 973 (or 60%) more in 2008 and 1,147 (or 70%) more in 2009. This large increase peaked in 2009. Third, the decline, starting in 2010, of the year-end “For Sale” inventory which has remained relatively unchanged over the past four years. The percentage for sale has declined more as a result of the growth of the in-operation fleet numbers, increasing from 17,118 in 2009 to 19,478 in 2013. The year-ending 2013 “For Sale” inventory

level is 2,435 or 12.5%.

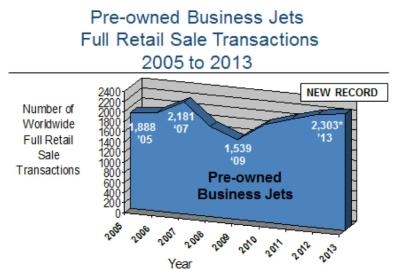

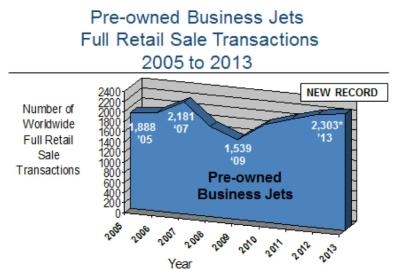

A new record of Pre-owned Full Retail Sale Transactions was set in 2013. There were 2,303 transactions in 2013, beating the previous record peaks of 2,181 in 2007 and 2,289 last year. This record follows four years of increases from the low of 1,539 transactions recorded in 2009.

However, other pre-owned market sectors are not showing similar results. They are showing decreasing sale transactions and have mixed average asking prices, with some greater and some less compared to the same 2012 period. Significant are the double-digit decreases in both the turbine and piston helicopter full retail sale transactions, and the increased time on the market before selling.

Overall, JETNET says the pre-owned market continues to be very active. Now that 2014 is here and there is renewed optimism, we hope this trend for the pre-owned market, along with improvements in the world economy, will continue to push more new aircraft purchases for the new year. As for now, it continues to be a buyer’s market, with pre-owned “For Sale” inventories running around 12.5%.

(Charts provided by JETNET)

Senator Pushes FAA to Accelerate Rocket Launch Licensing

Senator Pushes FAA to Accelerate Rocket Launch Licensing Classic Aero-TV: RJ Gritter - Part of Aviations Bright New Future

Classic Aero-TV: RJ Gritter - Part of Aviations Bright New Future Aero-FAQ: Dave Juwel's Aviation Marketing Stories -- ITBOA BNITBOB

Aero-FAQ: Dave Juwel's Aviation Marketing Stories -- ITBOA BNITBOB ANN's Daily Aero-Linx (10.27.24)

ANN's Daily Aero-Linx (10.27.24) ANN's Daily Aero-Term (10.27.24): Clearance Void If Not Off By (Time)

ANN's Daily Aero-Term (10.27.24): Clearance Void If Not Off By (Time)