Ancillary Fees Continue To Be A Major Revenue Center For

Carriers Large And Small

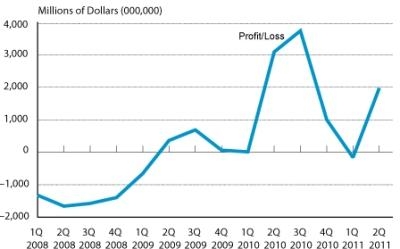

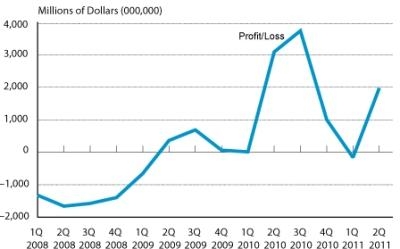

Scheduled passenger airlines reported a profit margin of 5.1

percent in the second quarter of 2011, up from the 0.5 percent loss

margin in the first quarter but a smaller profit margin than the

9.0 percent margin during the second quarter of 2010, according to

a report of preliminary data released Monday by the DOT's Bureau of

Transportation Statistics (BTS).

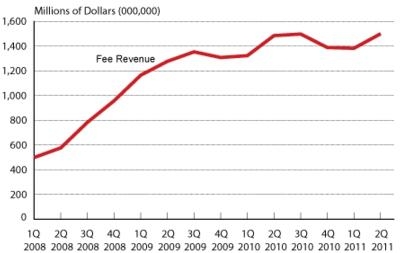

BTS Graph

BTS, a part of the Research and Innovative Technology

Administration, reported that the network airlines reported an

operating profit margin of 5.5 percent as a group in the

April-to-June period. The low-cost group's profit margin was 4.2

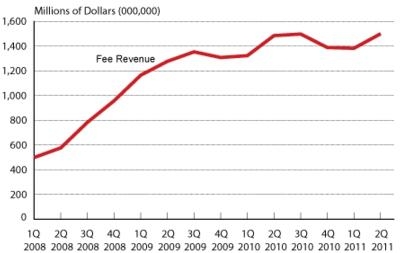

percent. As part of their second-quarter revenue, the airlines

collected $887 million in baggage fees and $612 million from

reservation change fees from April to June.

In addition to baggage and reservation change fees, airlines

reported ancillary revenue of $709 million from passengers and from

other sources. This revenue category includes revenue from frequent

flyer award program mileage sales and pet transportation fees.

Total second quarter 2011 airline revenue from all ancillary

sources that can be identified, including fees and frequent flyer

sales was $2.208 billion, with Delta Air Lines reporting the most,

$691 million.

Baggage fees and reservation change fees are the only ancillary

fees paid by passengers that are reported to BTS as separate items.

Other fees, such as revenue from seating assignments and on-board

sales of food, beverages, pillows, blankets, and entertainment are

reported in a different category with other items and cannot be

identified separately.

BTS Graph

The combined baggage and reservation change fees from passengers

combined with ancillary revenue from other sources constituted 5.5

percent of the total revenue of the 28 carriers that reported

receiving ancillary revenue. Spirit Airlines reported the largest

percent of operating revenue from ancillary revenue of any carrier,

29.7 percent.

The six network carriers posted a profit margin of 5.5 percent

in the second quarter with a combined operating profit of $1.6

billion. In the second quarter of 2010, the network carriers

reported a profit margin of 9.0 percent with a profit of $2.4

billion. The seven low-cost carriers reported a 4.2 percent profit

margin, with profits of $283 million for the 11th consecutive

profitable quarter. The seven regional airlines reported a 2.5

percent profit margin that included profits of $49 million.

Operating margin measures profit or loss as a percentage of the

airline’s total operating revenue. The top three operating

profit margins of the three carrier groups were reported by network

carriers Alaska Airlines and Continental and low-cost carrier

Spirit Airlines. Horizon Airlines reported the top loss margin of

any carrier.

Network carriers operate a significant portion of their flights

using at least one hub where connections are made for flights on a

spoke system. Low-cost carriers are those that the industry

recognizes as operating under a low-cost business model, with lower

infrastructure and aircraft operating costs and with less reliance

on the hub-and-spoke system. Regional carriers provide service from

small cities, using primarily regional jets to support the network

carriers’ hub and spoke systems. The selected network,

low-cost and regional groups consist of those airlines in each

group with the highest reported operating revenue in the most

recent complete calendar year.

ANN's Daily Aero-Linx (05.06.25)

ANN's Daily Aero-Linx (05.06.25) ANN's Daily Aero-Term (05.06.25): Ultrahigh Frequency (UHF)

ANN's Daily Aero-Term (05.06.25): Ultrahigh Frequency (UHF) ANN FAQ: Q&A 101

ANN FAQ: Q&A 101 Classic Aero-TV: Virtual Reality Painting--PPG Leverages Technology for Training

Classic Aero-TV: Virtual Reality Painting--PPG Leverages Technology for Training Airborne 05.02.25: Joby Crewed Milestone, Diamond Club, Canadian Pilot Insurance

Airborne 05.02.25: Joby Crewed Milestone, Diamond Club, Canadian Pilot Insurance