Unique Proposition Could Encourage ‘New Players’ To Enter The Business Jet And Helicopter Finance Market

The business jet and helicopter financier AirFinance today announced the launch of FlyFunder, an innovative online marketplace that effectively and efficiently connects buyers of business jets and helicopters with aviation financiers that match their borrowing profiles.

Not only will this help existing aviation finance companies find potential appropriate clients, hedge funds and family offices have also disclosed an interest in using the platform to enter the sector.

The unique proposition is launched at a time when securing finance in this market has become more difficult as some traditional lenders have pulled out because of financial losses incurred since 2008, and others because of the regulatory requirements from Basel III, which has made lending in smaller niche markets difficult from a balance sheet perspective.

Despite this, there are currently around 2,400 pre-owned business jets on the market for sale, and collectively they are worth $15.6billion. It estimates that the combined addressable market for financing new and pre-owned business jets and helicopters is around $44 billion annually.

"The current process for obtaining aircraft financing is a tedious and labor-intensive process that requires a large number of phone calls and emails," said Kirsten Bartok Touw, FlyFunder Co-Founder and AirFinance Managing Partner. ""Aircraft buyers or their representatives must reach out individually to multiple financial institutions to determine if they are interested in their specific deal. Each financial institution has a list of very specific attributes that they will finance including: deal size, age of aircraft, domicile of buyer, region of operation, registration of aircraft and type of structure.”

“With FlyFunder, we are offering the first digital platform to bring financiers and aircraft buyers together, and because there are no start-up costs involved for those looking to lend, we have been in talks with a number of hedge funds and family offices who are looking at this as a very efficient way to enter the business jet and helicopter finance market.”

FlyFunder was created to “match” financiers with aircraft buyers who meet their lending criteria. Upon registering, a financier inputs their desired customer profile and then gets notified when a deal gets “launched” that meets his or her lending requirements. Think of Match.com for aircraft financing.

In virtually all industries, there are marketplaces where consumers can easily search, get matched with and compare their options to find the best deal. Until now, this has not existed in the general aviation finance sector.

“FlyFunder will give financiers greater visibility into a larger number of aircraft financing opportunities than they would typically see through their origination teams. It is a great platform for buyers looking to access financing and financiers looking for potential deals they might otherwise not have been exposed to.” said Chris Miller, Shearwater Aero Capital, Managing Partner.

The site is free for all users to join, and the financiers only pay FlyFunder a small commission upon the successful closing of a transaction sourced from the platform. The process is also completely anonymous. When a deal is launched in FlyFunder’s closed network the information presented to the financier is general and non-specific so that an aircraft buyer is unidentifiable. Financiers declare their interest based on deal criteria rather than the identity of the customer.

FlyFunder was also developed with the aircraft broker/consultant community in mind. An aircraft manufacturer or consultant/broker can “launch” a transaction for their client. If the deal is launched by a broker/consultant, FlyFunder will share with the broker/consultant half of the fee the financier pays to it if the funding is consummated.

“We see significant growth potential in both mature and emerging markets,” said Paul Sykes, FlyFunder Co-Founder and Director. “We believe that a transparent, easy-to-use, online marketplace will provide aircraft buyers globally with greater access to financing and more options to choose from. All industry participants will benefit from greater connectivity and interaction."

It is well documented that the business jet market has never fully recovered from the 2008 economic crisis, in addition, the weakness in the commodity markets and consequently the emerging markets have further negatively impacted deliveries of new aircraft. In just the first half of 2016, unit sales of business jets, turbo props and pistons were all down more than 4.5%, and total general aviation airplane billings were down 11%, from $10.4 billion to $9.3 billion.

To make matters worse, many large financial institutions pulling out of aircraft financing business. Some note strategic reasons partly due to losses incurred during the financial downturn since 2008 and others point to Basel III regulatory requirements making lending in smaller niche markets difficult from a balance sheet perspective.

GE cited the reason for their exit that they wanted to trim their GE Capital organization and only focus on financing products that GE sold (they don’t sell business jets). In the case of CIT, they merged with a domestically focused U.S. bank, OneWest Bank. After the acquisition, it was announced that they would exit their asset financing businesses and focus on traditional middle market banking business. Many believe the same fate may be in store for Deutsche Bank if the German government has to inject financing.

All of this has made it harder for aircraft buyers to find financing solutions, particularly in jurisdictions outside of the US and Western Europe (the domiciles where most of the banks are located and are domestically focused), and for older and smaller aircraft types. Aircraft manufacturers are often scrambling for customer financing solutions to close a sale and without a financing solution buyers either defer their purchase or opt for a cheaper preowned aircraft.

In UBS’s October 18th business jet report, which includes a survey, 50% of their Asia Pacific participants felt the availability of financing had deteriorated, and 29% of Latin America participants expressed negativity. No Asia Pacific or Latin American respondents expressed optimism around the availability of financing. When organized by respondents, 18% of aircraft manufacturers felt the availability of financing had decreased and 27% of financiers. None of this bodes well for the future availability of financing. FlyFunder wants to change that.

“It has been demonstrated, that when financing exists, sales of assets increase when they don’t need to be purchased with 100% equity. It is our hope that FlyFunder can help increase aircraft sales by working to fill the financing void that has only grown in the last few years,” said Kirsten Bartok Touw, FlyFunder Co-Founder and AirFinance Managing Partner.

“By presenting aircraft financing opportunities in a clear and straightforward manner, we expect FlyFunder will expand the number of aircraft financed by lenders and lessors, especially when financiers see the opportunities they are missing due to their narrow criteria,” said Tom Low, FlyFunder Co-Founder and AirFinance Managing Partner. “Nontraditional funding sources such as hedge funds or family offices have already approached us, expressing interest in seeing aircraft financing opportunities that historically they would not have been able to source because of lack of focus on the sector.”

Since its beta launch in early fall, FlyFunder has had significant traction from aircraft buyers and brokers with more than a dozen deals launched from the United States to South Africa to Sri Lanka.

(Source: FlyFunder news release)

ANN's Daily Aero-Term (05.05.24): Omnidirectional Approach Lighting System

ANN's Daily Aero-Term (05.05.24): Omnidirectional Approach Lighting System Aero-News: Quote of the Day (05.05.24)

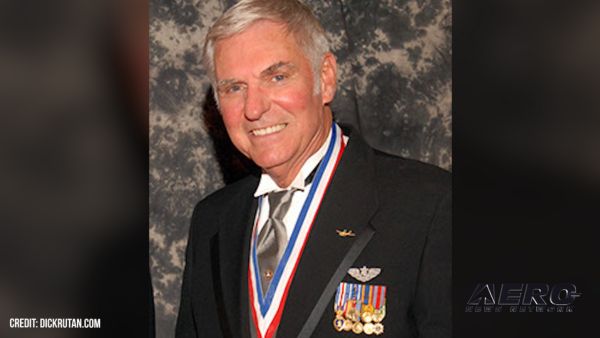

Aero-News: Quote of the Day (05.05.24) Airborne 05.06.24: Gone West-Dick Rutan, ICON BK Update, SpaceX EVA Suit

Airborne 05.06.24: Gone West-Dick Rutan, ICON BK Update, SpaceX EVA Suit Airborne 05.03.24: Advanced Powerplant Solutions, PRA Runway Woes, Drone Racing

Airborne 05.03.24: Advanced Powerplant Solutions, PRA Runway Woes, Drone Racing Aero-News: Quote of the Day (05.06xx.24)

Aero-News: Quote of the Day (05.06xx.24)