Mass Fleet Divestments Threaten Business Aviation

On 09 May 2023, Wheels Up founder and CEO, Kenny Dichter resigned in the face of his company’s mounting losses and potential bankruptcy.

Shortly thereafter, privately owned jet charter provider Vista Jet Global was flagged by British multinational professional services partnership Ernst & Young (EY), which stated of the air-carrier: “A material uncertainty exists that may cast significant doubt on the group’s ability to continue as a going concern.” Vista Jet Global’s founder and chairman has since vociferously denied his company is in dire straits.

Two-weeks later, on 26 May, North Carolina-based charter and fractional ownership concern Jet It—the world’s 12th largest private jet operator by the metrics of charter and fractional flight hours—informed its employees by way of letter that the company was closing down and their jobs were permanently terminated.

Collectively, the aforementioned companies represent hundreds of private aircraft worth billions of dollars—all of which were highly leveraged in a capital-intensive business with no evidence of ever having been profitable. The possibility of the pre-owned aircraft market being inundated with hundreds-upon-hundreds of almost-new business jets is starkly horrifying to a broad spectrum of aviation stakeholders—to include aircraft OEMs.

Aviation consultancies are predicting with increasing accord that pre-owned business jet inventories will, in the near-term, continue to rise while transactions and flight activity both fall. With worrying consistency, firms the likes of ALTEA, Essex, and Oliver Wyman portend ever-increasing numbers of pre-owned business jets coming to market over the next 12-months.

Between December 2022 and April 2023, the global inventory of pre-owned business aircraft grew from 1,175 to 1,325 units—an increase of 150 aircraft. Further disruption of the banking sector stands to accelerate the trend.

Consolidated data shows, also, a decline in transactions of pre-owned business aircraft. 2022 saw a total of 3,560 transactions of subject machines—some 14-percent fewer than 2021. Moreover, the average timespan pre-owned business aircraft remain on the market has risen from 291-days at the end of 2022’s fourth-quarter to 320-days at the end of April 2023.

Industry augurs divine operations of business aircraft will decline as a significant percentage of newcomers to private jet travel will—as global air-carriers restore service to pre-COVID levels—return to the first-class airline seats they vacated in 2020. Recent reports indicate a small year-over-year decline in worldwide business jet activity during 2023's first four months.

An area of particular interest to aviation industry analysts is the ultra-long-range business jet sector—specifically Gulfstream. Should deliveries of the Savannah-based plane-maker’s flagship G700 meet industry projections, the pre-owned aircraft market is apt to see a sharp increase in the availability of G550s and G650ERs—as well as accompanying, likely precipitous price-drops for each model.

ALTEA partner Andrew Butler posited: “Whilst inventories of both types [G550 and G650ER] have been relatively stable over the last six-months, a concerted effort to deliver G700 aircraft [in the face of certification delays] could bring a change in this sector. We recall that the numbers of G550 aircraft coming to market escalated once G650 deliveries began in earnest [G550 availability increased by over three-hundred-percent], so we might see a similar occurrence in the market again—this time potentially affecting the G650/ER types.”

Textron, too, stands to be impacted by recent upheavals in the fractional aircraft ownership and charter markets. In the event Wheels Up’s last-ditch efforts to avoid delisting from the New York Stock Exchange by dint of a reverse stock-split prove futile, the divestment of the company’s sizable fleet stands to flood the pre-owned business aircraft market with hundreds of low-time Textron Aviation business jets and turboprops. In addition to occasioning severely diminished sales of new Cessna and Beechcraft aircraft, such an occurrence would drive down the residual and resale values of subject planes as supplies of such wildly exceeded demand—thereby hamstringing aircraft owners, lenders, and lessors alike, and sharply curtailing demand for new Textron aircraft.

ANN's Daily Aero-Term (05.05.24): Omnidirectional Approach Lighting System

ANN's Daily Aero-Term (05.05.24): Omnidirectional Approach Lighting System Aero-News: Quote of the Day (05.05.24)

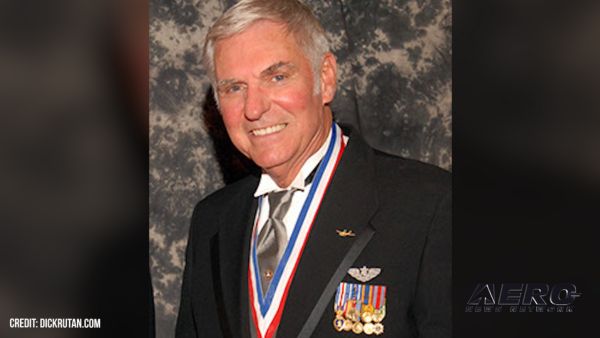

Aero-News: Quote of the Day (05.05.24) Airborne 05.06.24: Gone West-Dick Rutan, ICON BK Update, SpaceX EVA Suit

Airborne 05.06.24: Gone West-Dick Rutan, ICON BK Update, SpaceX EVA Suit Airborne 05.03.24: Advanced Powerplant Solutions, PRA Runway Woes, Drone Racing

Airborne 05.03.24: Advanced Powerplant Solutions, PRA Runway Woes, Drone Racing Aero-News: Quote of the Day (05.06xx.24)

Aero-News: Quote of the Day (05.06xx.24)