Tue, Aug 02, 2022

Biz Org Announces Tips to De-Risk Personal Use of Business Aircraft

The NBAA has completed a comprehensive update to its publication regarding personal business aircraft use, assisting its membership in enjoying maximum value from business aircraft while navigating the regulatory minefield of non-business use.

The publication, the Personal Use of Business Aircraft Handbook, walks readers through some valuable tax and regulatory compliance strategies required for aircraft use. Scott O’Brien, senior director at the NBAA over public policy and advocacy, said that demand for private aircraft has led to many members of the org to offer unused business planes for employee enjoyment. “Employee security concerns and ongoing pandemic-related travel changes may lead companies to occasionally make business aircraft available to employees for non-business use,” which sets them afield a complex and risky policy area. Personal use of business aircraft is an operation governed by a chorus of regulatory voices, including the Internal Revenue Service, the Securities and Exchange Commission, and of course, the Federal Aviation Administration.

“The Personal Use Handbook helps companies, chief financial officers, advisors and legal representatives to navigate this challenging regulatory environment,” explained O’Brien. “This is an important resource for flight department personnel who often work with their company’s tax department and outside counsel to assist in the recordkeeping and classification of flights.” Updates to income inclusion and deductions, with additional coverage regarding small businesses and sole proprietors enhance the level of coverage for the average flight department. New info regarding deduction-disallowance rules for commuting and business entertainment flights as stipulated by the Tax Cuts and Jobs Act of 2017.

“The NBAA Tax Committee worked collaboratively to finalize this updated guidance,” O’Brien said in describing the team that put the book together. “In particular, the association extends its thanks to committee members Ruth Wimer, with Winston & Strawn LLP, and Sue Folkringa, with Aviation CPAs, for their leadership in the update process, and to John Hoover, with Holland & Knight LLP, for his expertise.” The updates will be reviewed this October at the NBAA Tax, Regulatory, & Risk Management Conference in Orlando, Florida.

More News

Aero Linx: JAARS Nearly 1.5 billion people, using more than 5,500 languages, do not have a full Bible in their first language. Many of these people live in the most remote parts of>[...]

'Airplane Bounced Twice On The Grass Runway, Resulting In The Nose Wheel Separating From The Airplane...' Analysis: The pilot reported, “upon touchdown, the plane jumped back>[...]

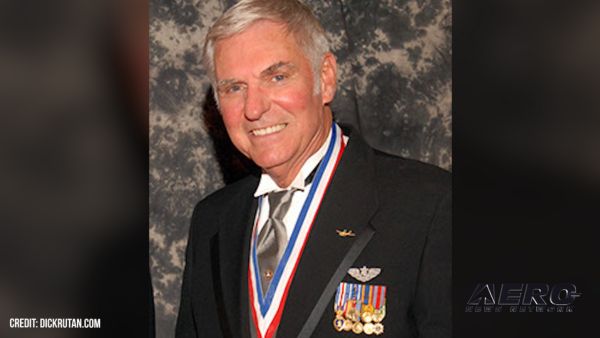

"Burt is best known to the public for his historic designs of SpaceShipOne, Voyager, and GlobalFlyer, but for EAA members and aviation aficionados, his unique concepts began more t>[...]

"Polaris Dawn, the first of the program’s three human spaceflight missions, is targeted to launch to orbit no earlier than summer 2024. During the five-day mission, the crew >[...]

There Are SO Many Ways To Get YOUR Aero-News! It’s been a while since we have reminded everyone about all the ways we offer your daily dose of aviation news on-the-go...so he>[...]

ANN's Daily Aero-Linx (05.04.24)

ANN's Daily Aero-Linx (05.04.24) NTSB Final Report: Quest Aircraft Co Inc Kodiak 100

NTSB Final Report: Quest Aircraft Co Inc Kodiak 100 Aero-News: Quote of the Day (05.04.24)

Aero-News: Quote of the Day (05.04.24) Aero-News: Quote of the Day (05.05.24)

Aero-News: Quote of the Day (05.05.24) Read/Watch/Listen... ANN Does It All

Read/Watch/Listen... ANN Does It All