Of Circling Vultures

The unsecured creditors of Sir Richard Charles Nicholas Branson’s imperiled Virgin Orbit have prevailed upon a Delaware bankruptcy judge to reject the satellite launch concern’s request to access nearly $32-million in Chapter 11 financing, contending Virgin Orbit’s parent company's arranged both the bankruptcy case and the post-filing loan for its own benefit.

In a motion filed Wednesday, 26 April, the unsecured creditors' committee accused Virgin Orbit's indirect parent company, Virgin Investments Ltd. (VIL), of willfully burdening the former entity with debt prior to commencement of the Chapter 11 proceedings and providing a debtor-in-possession financing package that saddles the case with an overly-tight timeline and budget, thereby limiting the recovery of unsecured creditors.

The creditors’ committee set forth: "Virgin Investments Ltd. should not be permitted to take advantage of the bankruptcy process for its sole benefit without ensuring the process is fair to all constituencies and sufficiently funded to prevent administrative insolvency.”

In its Chapter 11 filings, Virgin Orbit reported its launch revenues had been "comparatively small" and the net revenue from an attempted December 2021 effort to take the company public via merger with a special-purpose acquisition company had fallen short of expectations by some $300-million.

The committee added: "Instead of considering an appropriate wind-down or restructuring plan before the last minute, VIL waited until between November 2022 and March 2023 to begin strategically loading the debtors' balance sheet with over $70-million in debt, purportedly secured by substantially all of the debtors' assets."

The committee further stated the Debtor-In-Possession (DIP) financing comes with a total $42.5-million rollup of prepetition debt at a higher interest rate than the original loans and conditions that include a bid deadline of 15 May and a plan confirmation deadline of 03 July.

The committee argued that under the DIP budget, Virgin Orbit’s cash reserves will dwindle to $8,000 by 30 June, and Virgin Investment retains the right to sweep the company's accounts in the event the latter’s cash exceeds $2-million over the extant budget.

The committee stated: "The tight cash position leaves little margin for error and thus seems designed to preclude the pursuit of opportunities with qualified buyers who may require more time to complete their diligence—unless permitted by VIL in its discretion.”

The creditors’ committee pointed out no provision exists for wind-down expenses, adding that its members stand to receive only $50,000 to investigate potential claims against Virgin Investment—including claims the liens securing at least $25-million of the Virgin Investment notes are avoidable preferential transfers.

The committee noted the DIP facility, if approved, should occasion the removal of the cash sweep, increase the committee’s budget, increase of the sale timeline by at least two-weeks, restrict Virgin Investment’s credit bid rights, and pair back Virgin Investment’s DIP and pre-bankruptcy liens—thereby leaving assets available for recovery by unsecured creditors.

The creditors’ committee concluded: "At minimum … VIL should not be granted liens on, or super-priority claims to, the proceeds of any claims commenced against it or any of its affiliates or insiders.”

ANN's Daily Aero-Term (05.05.24): Omnidirectional Approach Lighting System

ANN's Daily Aero-Term (05.05.24): Omnidirectional Approach Lighting System Aero-News: Quote of the Day (05.05.24)

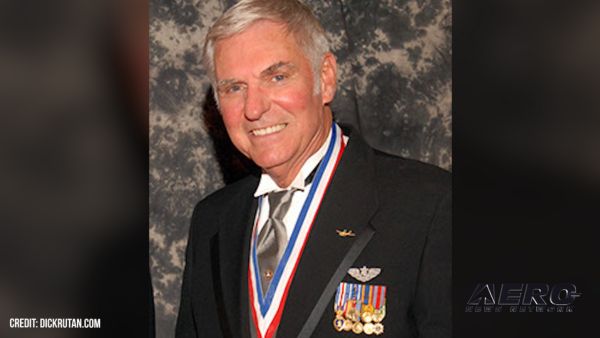

Aero-News: Quote of the Day (05.05.24) Airborne 05.06.24: Gone West-Dick Rutan, ICON BK Update, SpaceX EVA Suit

Airborne 05.06.24: Gone West-Dick Rutan, ICON BK Update, SpaceX EVA Suit Airborne 05.03.24: Advanced Powerplant Solutions, PRA Runway Woes, Drone Racing

Airborne 05.03.24: Advanced Powerplant Solutions, PRA Runway Woes, Drone Racing Aero-News: Quote of the Day (05.06xx.24)

Aero-News: Quote of the Day (05.06xx.24)