Wed, Feb 23, 2011

Timing Is Still Unsure, But One Analyst Thinks The Answer Is

"Soon"

Helicopters have a lot of moving parts -- as do all the

different and intertwining markets driving sales in this industry.

And GA analyst Brian Foley sees a bright spot in this, at least for

the rotorcraft market.

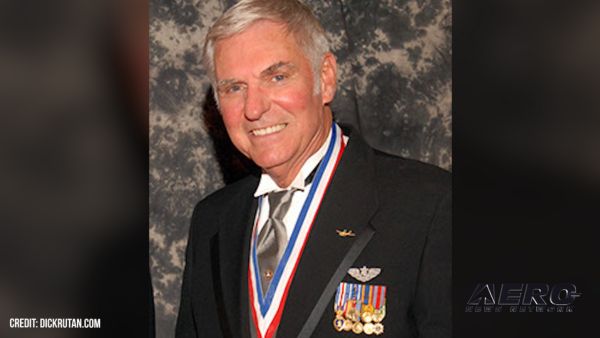

Foley

"Complexity is actually good from a diversity perspective. When

one market segment is performing poorly it's always good to have

another one, whose cycles may be different, to take up the slack.

The good news we're finally seeing is that helicopters look poised

to climb up from their current slump."

Foley cites a recent case where opposite ends of the market

(civil and military) helped to balance one another. The civil

corporate helicopter market was compromised as the recession and

credit freeze forced buyers to cancel orders. But while this was

happening, the military helicopter business proved more resistant,

which kept the industry working. During the same period business

jets, whose military market is tiny in comparison, saw deliveries

and payrolls plunge by nearly half.

Robinson R66

"There's an interesting dichotomy between helicopter civil and

military markets," Foley said. "Civil deliveries represent about

two-thirds of unit deliveries but less than one-third of the total

dollars. So the industry would have to sell a lot of tiny R-44's to

civilian customers to equal the value of just one Bell-Boeing's

V-22 Osprey. But now we're entering a period of reversal,

characterized by military budget cuts on the one hand and rising

corporate profits on the other. This should spur recovery in the

offshore-oil and executive-transportation segments which are part

of the civil industry's bread and butter."

Noting that helicopters were one of the last segments of general

aviation to enter the downturn and should therefore expect to be

among the last out, Foley believes that 2011 will be remembered as

a "trough year" in which deliveries finally bottomed out before

trending upwards. He also anticipates that the large and

fast-growing economies of India and China, for example, with their

lack of airport infrastructure and their likelihood of huge

construction projects, are ripe for rotorcraft.

More News

Aero Linx: JAARS Nearly 1.5 billion people, using more than 5,500 languages, do not have a full Bible in their first language. Many of these people live in the most remote parts of>[...]

'Airplane Bounced Twice On The Grass Runway, Resulting In The Nose Wheel Separating From The Airplane...' Analysis: The pilot reported, “upon touchdown, the plane jumped back>[...]

"Burt is best known to the public for his historic designs of SpaceShipOne, Voyager, and GlobalFlyer, but for EAA members and aviation aficionados, his unique concepts began more t>[...]

"Polaris Dawn, the first of the program’s three human spaceflight missions, is targeted to launch to orbit no earlier than summer 2024. During the five-day mission, the crew >[...]

There Are SO Many Ways To Get YOUR Aero-News! It’s been a while since we have reminded everyone about all the ways we offer your daily dose of aviation news on-the-go...so he>[...]

ANN's Daily Aero-Linx (05.04.24)

ANN's Daily Aero-Linx (05.04.24) NTSB Final Report: Quest Aircraft Co Inc Kodiak 100

NTSB Final Report: Quest Aircraft Co Inc Kodiak 100 Aero-News: Quote of the Day (05.04.24)

Aero-News: Quote of the Day (05.04.24) Aero-News: Quote of the Day (05.05.24)

Aero-News: Quote of the Day (05.05.24) Read/Watch/Listen... ANN Does It All

Read/Watch/Listen... ANN Does It All