Tue, May 09, 2017

Franchise Tax Board Seeks Public Comment On The Proposal

The California Franchise Tax Board is seeking public comment on a proposal to compute taxes on commercial space transportation companies, according to a report from the San Francisco Chronicle.

The board says that it created the proposed rules to give space entrepreneurs "confidence" that when their still-small businesses start to take off, the tax code for the state of California will be ready to accommodate them.

The code would apply to any company that derives at least half of its revenue from "space transportation" ... which is the movement of goods or people above an altitude of 62 miles ... and launches from California. CA companies that launch from other states, such as Florida or Texas, would not be subjected to the tax.

In the document, the state provides the following example: Taxpayer is a space transportation company that has entered into three launch contracts that result in the recognition of revenue in taxable year 201X. The first contract ("Contract A") is for two launches outside this state where the launch vehicles will each travel 1,000 miles from launch to separation. Taxpayer will recognize $2,000,000 of revenue in taxable year 201X from this contract. The second contract ("Contract B") is for one launch from outside of this state where the launch vehicle will travel 10,000 miles from launch to separation. Taxpayer will recognize $500,000 of revenue in taxable year 201X from this contract. The third contract ("Contract C") is for one launch from within this state where the launch vehicle will travel 1,000 miles from launch to separation. Taxpayer will recognize $1,000,000 of revenue in taxable year 201X from this contract. Taxpayer also has $500,000 of revenue from other than space transportation

activities.

The Franchise Board said that it got input from private space companies on the proposed rules. SpaceX is headquartered in Hawthorne, CA, but conducts many launches from Florida.

Currently, California is the only state considering such a tax on space launch activities.

(California launch image from file)

More News

Aero Linx: JAARS Nearly 1.5 billion people, using more than 5,500 languages, do not have a full Bible in their first language. Many of these people live in the most remote parts of>[...]

'Airplane Bounced Twice On The Grass Runway, Resulting In The Nose Wheel Separating From The Airplane...' Analysis: The pilot reported, “upon touchdown, the plane jumped back>[...]

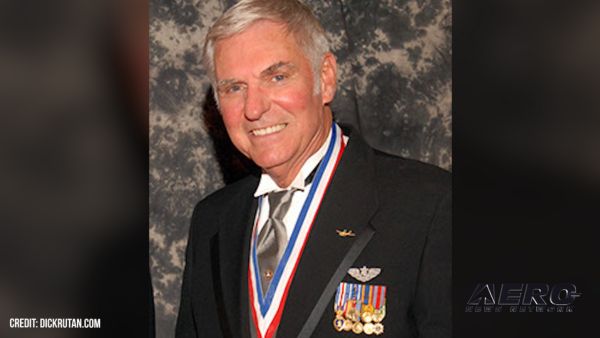

"Burt is best known to the public for his historic designs of SpaceShipOne, Voyager, and GlobalFlyer, but for EAA members and aviation aficionados, his unique concepts began more t>[...]

"Polaris Dawn, the first of the program’s three human spaceflight missions, is targeted to launch to orbit no earlier than summer 2024. During the five-day mission, the crew >[...]

There Are SO Many Ways To Get YOUR Aero-News! It’s been a while since we have reminded everyone about all the ways we offer your daily dose of aviation news on-the-go...so he>[...]

ANN's Daily Aero-Linx (05.04.24)

ANN's Daily Aero-Linx (05.04.24) NTSB Final Report: Quest Aircraft Co Inc Kodiak 100

NTSB Final Report: Quest Aircraft Co Inc Kodiak 100 Aero-News: Quote of the Day (05.04.24)

Aero-News: Quote of the Day (05.04.24) Aero-News: Quote of the Day (05.05.24)

Aero-News: Quote of the Day (05.05.24) Read/Watch/Listen... ANN Does It All

Read/Watch/Listen... ANN Does It All