Forecast Is For Annual Growth Of Nearly 27 Percent

The small satellite market study analyses the market at the global level, and provides forecasts in terms of revenue (US$ million) from 2019 to 2029. It recognizes the drivers and restraints affecting the industry and analyses their impact during the forecast period. It identifies the significant opportunities for market growth in the next few years. In addition, the market is segmented on the basis of classification, application and geography that is further divided into North America, Europe, Asia Pacific and rest of the world regions.

In addition, the geographic regions are studied at country level for this research study. Furthermore, the small satellite market based on classification is further segmented into nano, micro, mini, pico, and femto satellites, and applications into meteorology, security/surveillance, earthquake/seismic monitoring, scientific research and others, which includes earth observation, regional navigation, communication, marine and coastal environments, agriculture, forestry, cartography, environment, geology and exploration. The key players have been profiled and the information covered are company overviews, financial information, business strategies and recent developments.

The global small satellite market is projected to grow from $2,181.9 million in 2019 to $23,572.0 million by 2029, at a Compound Annual Growth Rate (CAGR) of 26.9% between 2019 and 2029. This report segments the small satellite market based on classification including nano, micro, mini, pico, and femto satellites and applications including meteorology, security/surveillance, earthquake/seismic monitoring, scientific research and others. It also includes regional analysis based on various countries including US, Canada, UK, Russia, Denmark, Germany, France, China, Japan, India, Indonesia, Singapore, Saudi Arab and Qatar. In addition, the small satellite market report 2019-2029 evaluates the rise in demand for small satellites as evidenced by the increase in small satellite launches in the last decade. Various emerging countries across the world are looking to develop a space-based capability, within a limited budget, and are doing so by investing in the development, manufacturing, and launch of small

spacecraft.

Additionally, the miniaturisation of electronics in the commercial sector has encouraged the development of smaller satellites, thereby enabling them to emerge as a crucial platform in a renewed global space race. Furthermore, budgetary constraints have also led various governments, military and civil users to consider small satellite platforms.

The report analyst commented "Various emerging countries across the world are looking to develop a space-based capability, within a limited budget, and are doing so by investing in the development, manufacturing, and launch of small spacecraft. Additionally, the miniaturisation of electronics in the commercial sector has encouraged the development of smaller satellites, thereby enabling them to emerge as a crucial platform in a renewed global space race. Furthermore, budgetary constraints have also led various government, military and civil users to consider small satellite platforms."

Leading companies featured in the report are Airbus Group, Aerospace Corporation, Harris Corporation, Leonardo S.p.A., Lockheed Martin, Maxar Technologies Inc., Northrop Grumman, ORBCOMM Inc., The Boeing Company, Thales Group.

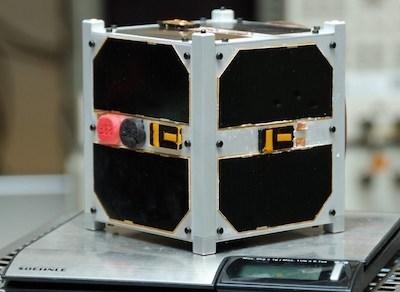

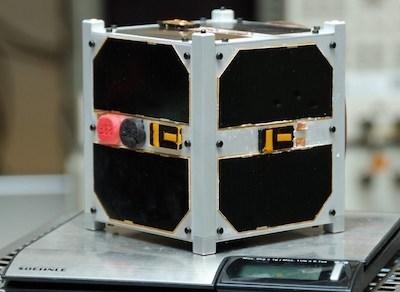

(Image provided with ASDReports news release)

ANN's Daily Aero-Term (04.24.24): Runway Lead-in Light System

ANN's Daily Aero-Term (04.24.24): Runway Lead-in Light System ANN's Daily Aero-Linx (04.24.24)

ANN's Daily Aero-Linx (04.24.24) Aero-FAQ: Dave Juwel's Aviation Marketing Stories -- ITBOA BNITBOB

Aero-FAQ: Dave Juwel's Aviation Marketing Stories -- ITBOA BNITBOB Classic Aero-TV: Best Seat in The House -- 'Inside' The AeroShell Aerobatic Team

Classic Aero-TV: Best Seat in The House -- 'Inside' The AeroShell Aerobatic Team Airborne Affordable Flyers 04.18.24: CarbonCub UL, Fisher, Affordable Flyer Expo

Airborne Affordable Flyers 04.18.24: CarbonCub UL, Fisher, Affordable Flyer Expo