Wed, Oct 19, 2016

Represents Forecast Of Moderate Growth Over The Period

The global flight simulators market is expected to reach $5.62 billion by 2024, according to a new report by Grand View Research, Inc. Increasing adoption of FFS owing to high fidelity and reliability is expected to provide adequate growth prospects over the coming years. Customers also opt for FTDs because of their low operational costs, modular approach, real-time aerodynamic flight model, and remote configuration as well as management. Those factors will drive growth over the forecast period, according to the report.

The need to effectively replicate real flying training with the usage of motion and visual systems has resulted in the introduction of sophisticated simulators in the market. Increase in government spending and growing security concerns particularly in the military sector is anticipated to escalate product demand significantly. The rising concerns over pilot training cost along with fluctuating fuel prices may further drive demand for flight simulators over the next eight years.

The report also suggests:

- The FFS product segment accounted for over 90% of the overall revenue in 2015 and is expected to grow at a CAGR of over 4% from 2016 to 2024. This growth is owing to features that provide motion, sound, visuals, and all other aircraft operations that create a realistic flight training environment.

- The demand in civil application segment is primarily due to the rising air traffic coupled with the growing emphasis on the passenger as well as pilot safety. Governments in several countries have enforced strict regulations regarding the use and significance of simulation training.

- The services segment is anticipated to grow at a CAGR exceeding 3.0% over the forecast period. This is primarily attributed to the rise in number of simulator installation by international airways.

- Europe accounted for more than 30% of the overall market share in 2015 and is expected to exhibit a modest growth over the next eight years on account of the elevating enforcement of regulations pertaining to pilot training and passenger safety.

The Asia Pacific flight simulators market is estimated to exhibit a substantial growth over the forecast period in light of the growing aviation industry, resulting in the increasing demand for flight simulators. The Middle East & Africa is also projected to showcase a substantial demand of over 4%, which is primarily be attributed to the presence of carriers including Emirates, Etihad Airways, and Qatar that are investing heavily in this industry.

Prominent industry players include CAE, Boeing, L-3 Link Simulation & Training, Lockheed Martin, Rockwell Collins, Thales and SaaB. Industry participants emphasize on joint ventures, mergers and acquisitions in order to acquire greater financial, technical, marketing, manufacturing and distribution expertise.

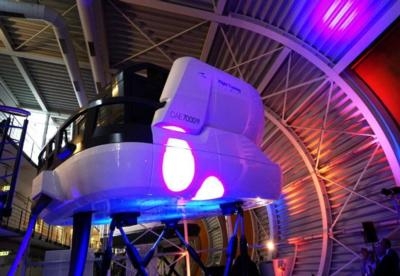

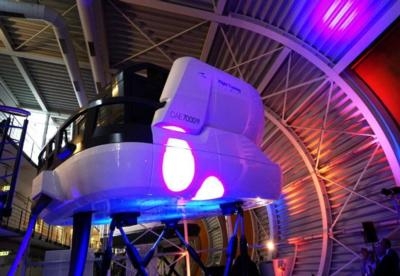

(Source: Grand View Research news release. Image from file)

More News

Runway Lead-in Light System Runway Lead-in Light System Consists of one or more series of flashing lights installed at or near ground level that provides positive visual guidance a>[...]

Aero Linx: Aviation Without Borders Aviation Without Borders uses its aviation expertise, contacts and partnerships to enable support for children and their families – at hom>[...]

Dave Juwel's Aviation Marketing Stories ITBOA BNITBOB ... what does that mean? It's not gibberish, it's a lengthy acronym for "In The Business Of Aviation ... But Not In The Busine>[...]

From 2010 (YouTube Version): Yeah.... This IS A Really Cool Job When ANN's Nathan Cremisino took over the lead of our Aero-TV teams, he knew he was in for some extra work and a lot>[...]

Also: Junkers A50 Heritage, Montaer Grows, Dynon-Advance Flight Systems, Vans' Latest Officially, the Carbon Cub UL and Rotax 916 iS is now in its 'market survey development phase'>[...]

ANN's Daily Aero-Term (04.24.24): Runway Lead-in Light System

ANN's Daily Aero-Term (04.24.24): Runway Lead-in Light System ANN's Daily Aero-Linx (04.24.24)

ANN's Daily Aero-Linx (04.24.24) Aero-FAQ: Dave Juwel's Aviation Marketing Stories -- ITBOA BNITBOB

Aero-FAQ: Dave Juwel's Aviation Marketing Stories -- ITBOA BNITBOB Classic Aero-TV: Best Seat in The House -- 'Inside' The AeroShell Aerobatic Team

Classic Aero-TV: Best Seat in The House -- 'Inside' The AeroShell Aerobatic Team Airborne Affordable Flyers 04.18.24: CarbonCub UL, Fisher, Affordable Flyer Expo

Airborne Affordable Flyers 04.18.24: CarbonCub UL, Fisher, Affordable Flyer Expo