Augury in the Information Age

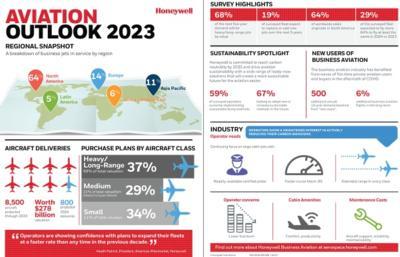

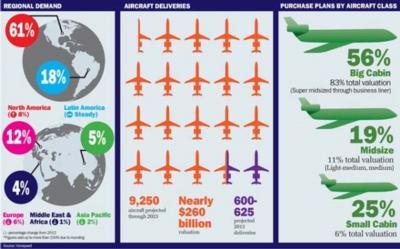

Honeywell's 32nd annual Global Business Aviation Outlook forecasts up to 8,500 new business jet deliveries worth $278-billion from 2024 to 2033, in line with the same ten-year forecast a year ago. This year, surveyed business aviation operators reported higher five-year new jet purchase plans, which is up two percentage points from a year ago. However, fleet expansion rates nearly tripled in 2023's survey compared to the decade average preceding 2020. The intentions gathered from respondents are consistent with what the OEMs reported to investors in Q2 — an increase in delivery pace during the first half of 2023, which further aligns with the industry's efforts to scale up production in response to record-high backlogs.

"Our industry is on the upswing. Operators are showing confidence with plans to expand their fleets at a faster rate than any time in the previous decade. Notably, we are excited by the recent announcements from fractional operators indicating their intent to acquire several hundred new jets, including midsize and super-midsize jets powered by Honeywell HTF engines," said Heath Patrick, president, Americas Aftermarket, Honeywell Aerospace. "There's also a positive shift toward sustainability, as operators are keen to reduce carbon emissions. Additionally, new users in business aviation have increased demand by 500 aircraft and 6% more flights over the next 10 years. This, along with expected double-digit increases in turbofan deliveries in 2023 and 2024, shows our industry's commitment to meeting growing demand."

Key findings in the 2023 Honeywell Global Business Aviation Outlook include:

- New business jet deliveries in 2024 are expected to be 10% higher than in 2023. Expenditures are expected to be 13-percent higher.

- Five-year purchase plans for new business jets are up two percentage points compared with last year's survey; this surpasses 2019 levels and is equivalent to 19-percent of the current fleet.

- Fleet additions are up for the third year in a row, topping three-percent of the fleet.

- New jet deliveries and expenditures over the next decade are projected to grow at a two-percent average annual rate, in line with expected worldwide long-term economic growth.

- Nearly two-thirds of those surveyed expect to fly the same in 2024 versus 2023; 29-percent expect to fly more, and just seven-percent expect to fly less.

- Large, long-range and ultra-long-range aircraft classes are expected to account for about 69-percent of all expenditures of new business jets in the next five years.

- Four-percent of surveyed operators plan to dispose of an aircraft without replacement, which is double of the rate gleaned in 2022; most citing retirement or death of the aircraft owner.

Honeywell is committed to reaching carbon neutrality by 2035 in its operations and facilities and to driving aviation sustainability with a wide range of ready-now solutions that will support a more sustainable future for the sector. This year's survey, for the third consecutive year, features a dedicated section on operators' current and future plans to reduce their carbon footprint during operations.

- Almost sixty-percent of this year's surveyed operators report currently implementing at least one method to reduce their carbon footprint, which is ten percentage points above last year's survey.

- The most frequently mentioned current method to reduce carbon footprint is "fewer private jet trips in favor of commercial flying" (31-percent), followed by "slower cruising speeds" (18-percent).

- In all, 67-percent of operators plan to either adopt or increase methods for more environmentally friendly operations in the future, and forty-percent cite SAF as the most common way to achieve this goal.

- The survey asked the remaining 33-percent what would compel them to adopt any methods to address sustainability in the future, and 65-percent of these operators cited economic incentives such as tax benefits or operating cost savings followed by 44-percent citing government regulations.

North American fleets account for 64-percent of the five-year new jet deliveries. This year's share is on par with last year's and is likely driven by ninety-percent of North American respondents believing that the economy will at least remain the same if not improve. This makes North America the most optimistic region in 2023.

European operators will make up 14-percent of the five-year new jet deliveries. This is one percentage point below last year's share, driven by economic uncertainty and a strong focus on sustainability in this continent.

Operators in the Latin American region will make up five-percent of global deliveries in the next five years, two percentage points below 2022's share. Nearly seventy-percent of Latin American operators report that local economic conditions will remain the same or decline in the near future, making this region the most pessimistic.

The Asia Pacific region will make up 11-percent of new jet demand over the next five years, one percentage point up from the previous year. Asian Pacific operators have seen the second-highest business aviation utilization growth in 2023 behind only the Middle East.

Middle East/Africa fleets will account for six-percent of the five-year new jet deliveries. This is two percentage points above last year's share. This region accounted for the most growth in business aviation flights in 2023.

Five-year purchase plans for pre-owned jets total 27-percent of the current fleet, just one percentage point below last year's results. After record-high demand for used jets the past two years, 2023 will see a slight increase in the inventory of jets available for sale.

The business aviation industry experienced a surge in first-time private aviation users and buyers after the onset of the COVID-19 pandemic. At certain points in 2022, this trend drove flight activity to levels not seen since 2007. However, in 2023, global flight activity declined and is expected to decrease this year by approximately four-percent compared with 2022. The decline has been attributed to factors such as inflation and the resumption of commercial air service on key routes.

Furthermore, the pace of new orders for jets has slowed down while OEMs focus on meeting current demand by significantly increasing production rates over the next several years. It is anticipated that flight activity will stabilize in 2024 and return to growth in 2025, driven by an accelerated pace in IPOs, corporate profits and easing inflation rates. Consequently, we will be able to assess in 2024 how many of these new users and buyers have remained in the business aviation sector and determine their long-term impact. However, a large impact is already being felt:

- The pre-COVID 2020 long-term new jet delivery forecast contained just over eight-thousand aircraft for the 2024-2033 period, while the latest 32nd Annual Honeywell Outlook forecasts 8,500.

- 2023 flight activity is still expected to finish at least ten-percent above 2019 levels; assuming an historically consistent average annual growth rate of one-to-two-percent, it can be anticipated that 2023 will conclude with flight activity two-to-six-percent above the point at which the industry would likely have been had it not been impacted by COVID.

The Global Business Aviation Outlook reflects current operator concerns and identifies longer-cycle trends that Honeywell uses in its own product decision process. The survey has helped identify opportunities for investments in sustainability solutions, has expanded propulsion offerings, innovative safety products, services and upgrades, and has enhanced aircraft connectivity offerings. The survey informs Honeywell's business pursuit strategy and helps consistently position the company on high-value platforms in growth sectors.

Honeywell's forecast methodology is based upon multiple sources, including macroeconomic analyses, original equipment manufacturers' production and development plans shared with the company, and expert deliberations from aerospace industry leaders. Honeywell also uses information gathered from interviews conducted during the forecasting cycle with one-hundred non-fractional business jet operators representing a fleet of 206 business aircraft worldwide. The survey sample is representative of the entire industry in terms of geography, operation and fleet composition. This comprehensive approach provides Honeywell with unique insights into operator sentiments, preferences and concerns and provides considerable insight into product development needs and opportunities.

ANN's Daily Aero-Term (04.28.24): Airport Marking Aids

ANN's Daily Aero-Term (04.28.24): Airport Marking Aids Aero-News: Quote of the Day (04.28.24)

Aero-News: Quote of the Day (04.28.24) ANN's Daily Aero-Linx (04.28.24)

ANN's Daily Aero-Linx (04.28.24) Aero-News: Quote of the Day (04.29.24)

Aero-News: Quote of the Day (04.29.24) ANN's Daily Aero-Linx (04.29.24)

ANN's Daily Aero-Linx (04.29.24)