Fills A Void Left By Commercial Airline Service

Commentary By Kathryn B. Creedy

There is, perhaps, no more exciting place to be in private aviation than in the subscription, on-demand models such as Surf Air, Wheels Up, Hopscotch Air and Imagineair just to name a few of these new companies. The reason is simple. They are filling a void left by the commercial airline industry, which has abandoned not only smaller markets but intra-state and intra-regional services. At the same time, they are expanding use of business aviation and tapping new market opportunities.

Now for the first time, a major business jet OEM – Embraer Executive Jets – is touting the potential of these businesses to not only tap into the dissatisfied and over-hassled airline passenger but to actually provide better, more efficient service for those who haven’t had the opportunity to fly private.

Embraer Executive Jet CEO Marco Tulio Pelegrini wants business aviation to be more like airlines rationalizing fleets, right sizing their aircraft and gaining more passengers and aircraft. In fact, he wants to jump start the evolution by attracting leasing companies to the market.

Noting that 50% of commercial airline deliveries are leased aircraft, he’d like to see that same ratio for the business aviation industry. Embraer also said the business aviation industry can do a lot to reduce costs and increase efficiency. He noted the variety of aircraft most companies have to be all things to all demand, is counterproductive, again harkening back to the airline industry where focusing on a few types simplifies operations. In fact, he said business aviation should focus on one or two types and maximize operations as these new business models do.

“They need to be more like an airline than a charter company,” he said. “Airlines are rationalizing and right sizing their fleets and we should be doing the same with executive aviation. We are doing everything to help operators develop viable a business case to expand their opportunities.”

These new companies have been much in the news. JetBlue recently took a minority stake in JetSuite saying it was part of its West Coast strategy to invest in innovative ideas. JetSuite already works with international airlines connecting Los Angeles-bound airline passengers to domestic points once they land in the US. Both Wheels Up and Surf Air are planning major European expansions that would mean the acquisition of many more aircraft.

In addition, a growing number of airlines are developing private jet programs including Lufthansa, Korean Air and, of course Delta Private Jets, the oldest such company in the business.

While press reports indicate that these new business models are crimping the sale of new jets, they are actually looking at increasing fleets. These new models are talking major fleet and network expansion. In addition, the more people discover the efficiencies of private aviation the more they will be attracted to it and the more aircraft these companies will buy.

Surf Air is discussing the acquisition of 50 small executive jets, perhaps the Phenom 300 or a small Cessna jet that would mean a $500 million order. Embraer also met with Wheels Up during NBAA. In fact, Wheels Up sees a need for up to 200 more aircraft for its expanding operations both in the US and Europe and is mulling the acquisition of the Citation 10 or Sovereign from the pre-owned market. It’s original King Aire order was 105 aircraft and it is now in its second tranche of deliveries.

UK-based JetSmarter recently announced a major European expansion. Hopscotch Air is marketing its Southern California expansion as saving Californians from endless traffic jams and the problems of flying regional airlines.

“We are working with operators in the US, Europe and Brazil,” said Embraer Executive Jet CEO Marco Tulio Pelegrini. “We are approaching them and helping them develop a business case on how viable these operations are.”

But Embraer is also working with the leasing companies to educate them on the value of business aviation and the potential of these new business models in order to get them involved in financing fleets, something that has been missing in the business aviation equation. He decried the low utilization of business aircraft at 200-300 hours annually when the aircraft, at least at Embraer, are designed for 2,000 to 3,000 hours.

He indicated OEMs, operators and customers all see the opportunities in providing point-to-point service. Financiers and leasing companies are not yet in the conversation. “It is up to us to educate them to the potential and provide the business case,” he said. “It is up to us to increase the use of business aviation.”

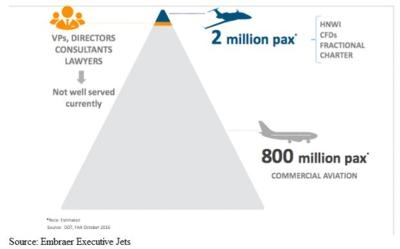

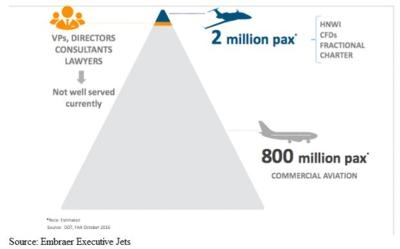

These upstart quasi air taxi/airlines, have actually designed the networks around increasing the number of people who use business aviation from the current, and rather stagnant, two million. Wheels Up CEO Kenny Dichter said his membership model is designed to attract more people, using his term, to private aviation. Now, Embraer has jumped on the bandwagon singing the praises of these new companies and their potential to turn business aviation on its head.

Perhaps it takes someone with the airline industry perspective to see the negative impact of the changes to commercial aviation and how business aviation provides the solution for not only the hassle factor of flying airlines but the length of time it takes to complete a mission.

While the industry has been selling use of its aircraft as a time machine for years, it is these new entrepreneurial start ups that are making it happen and expanding the market exponentially. Dichter indicated the current business aviation market has the potential to be expanded 10 times with these new business models.

Consider this, executives at companies say that 50%-60% of their passengers are new to business aviation. That is an incredible expansion in the market in the few short years they have changed private aviation travel and clearly it illustrates there is demand.

Pelegrini compared the relatively miniscule business aviation market to the 800-million-passenger commercial aviation market. He pointed to the Carlsbad-San Jose, CA city pair as a perfect example noted that despite the many attempts to develop airline service there only to become the victim of airline consolidation. JetSuite now serves the market and cuts four hours off the airline journey.

Mind you, this is not a choice between commercial or private. These new models are serving markets – mostly point-to-point – airlines have abandoned in their quest to build fortress hubs. That changes the equation both for their staying power and for the value of aircraft and that may make the difference for lessors.

“The business market – high net worth individuals, fractional and charters – are two million passengers,” he told assembled press during NBAA’s press day. “Meanwhile vice presidents, directors, consultants, lawyers who do not use business aviation are not well served by the commercial aviation industry.”

And that provides a lot of opportunities to both sell aircraft and actually provide a service for which passengers will pay a premium. The industry has been saying for years that business aviation serves far more airports than airlines for years but that has not drawn the new passenger numbers the way these new entrepreneurial companies have. So, yes, Embraer has a point that the future lies in these companies and OEMs must help them do it in order to sell more aircraft.

(Source: Embraer. Images from Embraer presentation from NBAA News Conference)

ANN's Daily Aero-Term (05.07.24): Hazardous Weather Information

ANN's Daily Aero-Term (05.07.24): Hazardous Weather Information ANN's Daily Aero-Linx (05.07.24)

ANN's Daily Aero-Linx (05.07.24) Airborne 05.01.24: WACO Kitchen, FAA Reauthorization, World Skydiving Day

Airborne 05.01.24: WACO Kitchen, FAA Reauthorization, World Skydiving Day Airborne Affordable Flyers 05.02.24: Bobby Bailey, SPRG Report Cards, Skydive!

Airborne Affordable Flyers 05.02.24: Bobby Bailey, SPRG Report Cards, Skydive! Airborne 05.03.24: Advanced Powerplant Solutions, PRA Runway Woes, Drone Racing

Airborne 05.03.24: Advanced Powerplant Solutions, PRA Runway Woes, Drone Racing