Government Adds Airport Tax For GA And Commercial Airplanes, Including Fuel Stops

In a move questioned by many in the GA world, the government of the Bahamas began charging new airport taxes July 1st. The new tax for private aircraft arriving in the Bahamas is $50, and it applies to en route fuel stops.

According to information provided by Caribbean Flying Adventures, pilots of private aircraft will be charged a $50 fee for a "cruising permit for private aircraft entering the Bahamas," even if that aircraft is simply stopping for fuel and continuing on to a non-Bahamian destination. That boosts the costs for technical fuel stops for safety by $50.

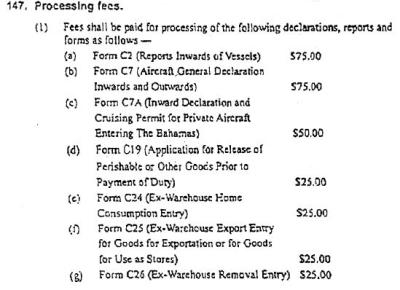

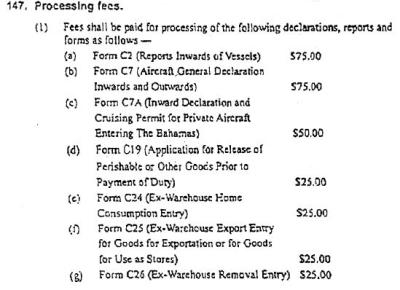

This tax is being labeled a "processing fee" for General Declaration forms. Departure taxes do not apply for a fuel stop, although Jim Parker of Caribbean Flying Adventures says he has received reports this year of some Out Island customs officers charging the fee.

In addition, the government has imposed a passenger departure tax of $25 which also applies to the crew - making the Bahamas the only island nation that applies departure taxes to crew members. The new regulation states that the $25 also applies to children below the age of 6.

"So now your day trip to Bimini with three passengers in your C172 opens with a $150 bill before you even begin spending your tourism dollars," Parker said. "The Bahamas reaps millions in tourism dollars from private aviation. These new taxes will certainly discourage many pilots from visiting the Bahamas and will result in a net loss of revenue for the economy.

"I have written the Minister of Transport and Aviation to ask that she raise this issue at the most senior levels of government. My suggestion was to exempt private flights for tourism. This ill-advised policy will hurt the Bahamas tourism sector, Bahamas fuel suppliers and south Florida FBO's," Parker said.

The fuel supplier for Hawkline Aviation at Stella Maris airport, which serves the Stella Maris resort on Long Island in the Bahamas, says a $10 customs fee for importing fuel has been replaced by a 1 percent charge on the value of the fuel, plus the cost of ocean freight and imputed freight insurance. Though the person, who chose to remain anonymous, said that even though they elect not to insure, Customs calculates what it would cost and charges the excise tax on that amount. The source said that the bottom line is that the price of fuel in the Bahamas will be going up.

In a number of e-mails received by ANN thorugh late Wednesday, Parker said that on a flight to the Bahamas that day, he was given conflicting interpretations as to the new regulations.

According to Parker, there is no mention of commercial vs. private. "The fees are based on the forms used. $75 for general declaration forms both inbound and outbound. $50 for the C7A cruising permit. Customs at Stella Maris told me private planes would only pay $50 and that fee would cover the outbound leg as well. They said this had been confirmed by Nassau officials.

"Today at Exuma I landed for fuel and presented the usual inbound and outbound gendecs. The customs lady said 'that will be $150 please.'” He was shown a menu of fees, which included the $50 for the C7A cruising permit. "I wound up submitting a cruising permit to another customs officer and paid $50. The customs lady said, 'you cannot depart with the inbound cruising permit. You need to submit an outbound GenDec.(General Declaration)' I believe she is correct but the customs gent let me go for only $50."

Parker say that for private pilots, the fee appears to be $50 inbound if you submit a cruising permit, even if you will not be cruising, and $75 for the outbound GenDec. That $125 plus the $25 departure tax for everyone on the aircraft. He said the only thing that is clear is that you only pay once for the cruising permit.

Parker said he heard a rumor Wednesday that the fee increases for boats has been rescinded. "Let’s see what happens," he said.

ANN's Daily Aero-Linx (04.16.24)

ANN's Daily Aero-Linx (04.16.24) Aero-News: Quote of the Day (04.16.24)

Aero-News: Quote of the Day (04.16.24) Airborne 04.10.24: SnF24!, A50 Heritage Reveal, HeliCycle!, Montaer MC-01

Airborne 04.10.24: SnF24!, A50 Heritage Reveal, HeliCycle!, Montaer MC-01 Airborne 04.12.24: SnF24!, G100UL Is Here, Holy Micro, Plane Tags

Airborne 04.12.24: SnF24!, G100UL Is Here, Holy Micro, Plane Tags Airborne-Flight Training 04.17.24: Feds Need Controllers, Spirit Delay, Redbird

Airborne-Flight Training 04.17.24: Feds Need Controllers, Spirit Delay, Redbird